tax benefit rule quizlet

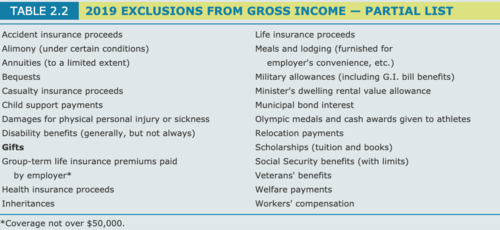

Gross income does not include income attributable to the. Under the tax law certain tax benefits can significantly reduce a taxpayers regular tax amount.

Federal Income Tax Flashcards Practice Test Quizlet

If this principle could be implemented the allocation of resources through the public sector would respond directly to consumer wishes.

. The policy is intangible and pays a benefit either in case of maturity or death during the term of the plan. This process is often complicated by the complexity of the related tax rules for personal use of a company vehicle. The Often Overlooked Income Tax Rules of Life Insurance Policies Donald O.

Fringe benefit given to rank and file employees is not subject to fringe benefits tax B. You must provide your SSN or ITIN to the spouse or former spouse making the payments otherwise you may have to pay a 50 penalty. Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2020.

Under age 19 at the end of the year and younger than you or your spouse if you file a joint return. To be a qualifying child for the EITC your child must be. Taxation - taxation - The benefit principle.

Ordinary loss allowed on Section 1244 stock. Their AGI was 104825 and itemized deductions were 27800 which included 22240 in state income tax and no other state or local taxes. Nonresident Alien Income Tax Return attach Schedule NEC Form 1040-NR PDF.

Fringe benefit given to a supervisory or managerial employee is subject to fringe benefits tax C. Often applies to refunds of itemized deductions like state income tax and medical expense deductions. Accounting questions and answers.

De minimis benefit whether given to rank and file employee or to supervisory or managerial employee is not subject to fringe benefit tax D. Under age 24 at the end of the year and a full-time student for at. So the tax benefit you received from the 300 refund was only 225.

A taxpayer itemized in 2011 and deducted state income taxes paid in 2011. It helps to ensure that those taxpayers pay at least a minimum amount of tax. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the money must be treated as taxable income.

To determine if an excess benefit transaction. The responsibility to withhold tax on retirement benefits depends on whether the retirement benefit is considered taxable which shall be determined by the law used in granting such benefit. What Are The Advantages Of Organizing A Partnership Quizlet.

If the money is used for anything outside of the qualified education expenses the family must pay a tax penalty of 10 on the plans earnings. You buy the policy with a term ranging anywhere from 5 years to 35 years. If an amount deducted as an itemized deduction in one year is refunded in a subsequent year it must be included in gross income in the year in which it is refunded to the extent to which a tax benefit was obtained in deducting this amount.

A life insurance policy is a long term contract. Of course if you were not able to itemize for 2012 none of your state tax refund is taxable for 2013. 529 Plan Rules for When a Child Skips College.

Myrna and Geoffrey filed a joint tax return in 2019. Partnerships have both advantages and disadvantages. The advantage of this model is the ease of setting up the ease of management the easy attraction of capital the large size makes it more practical to operate and the ability to attract skilled employees.

Domestic production activities deduction. An excess benefit transaction is a transaction in which an economic benefit is provided by an applicable tax-exempt organization directly or indirectly to or for the use of a disqualified person and the value of the economic benefit provided by the organization exceeds the value of the consideration received by the organization. Report alimony received on Form 1040 or Form 1040-SR attach Schedule 1 Form 1040 PDF or on Form 1040-NR US.

The alternative minimum tax AMT applies to taxpayers with high economic income by setting a limit on those benefits. Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2020. June 24 2021.

Published by David Klasing at March 21 2014. Myrna and Geoffrey filed a joint tax return in 2019. Under the benefit principle taxes are seen as serving a function similar to that of prices in private transactions.

Basic rules on fringe benefits tax except A. For more information see Disability and Earned Income Tax Credit. But the benefit to the employee isnt completely free under current tax law.

A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a subsequent yearthe money must be counted as income in the subsequent year. 556 Alternative Minimum Tax. If an amount is zero enter 0.

Taxation Planning and Compliance Insights Life insurance is a unique product that provides needed liquidity during the lifetime and at the death of the insured. Which provision could best be justified as encouraging small business. Under the so-called tax benefit rule a taxpayer need not include in his gross income and therefore need not pay tax on it amounts recovered for his loss if he did not receive a tax benefit for the loss in a prior year.

If an amount is zero enter 0. Any age and permanently and totally disabled at any time during the year. The tax benefit rule is codified in 26 USC.

Interest deduction on home mortgage. It is useful in business and estate planning and can be a wealth. Their AGI was 85000 and itemized deductions were 25100 which included 7000 in state income tax and no other.

The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event depend in some degree on the prior related tax treatment. Equivalently stated taxpayers must include in income any amounts recovered if they. Examples of tax benefit.

A 529 college savings plan allows families to save money for their childs college education in a tax-free investment account. Essentially personal use of a company car is treated as a taxable fringe benefit subject to income tax withholding obligations by the employer. That is they help determine what activities the government will undertake and who will pay for them.

Jansen Esq and Lawrence Brody Esq. However many times than not you want to give up your policy before its stipulated tenure.

R2 M2 Itemized Deductions Flashcards Quizlet

Accy 405 Tax Chapter 5 8 Flashcards Quizlet

Accy 405 Tax Chapter 5 8 Flashcards Quizlet

Additional Information For Reg Flashcards Quizlet

R1 M3 Gross Income Part 2 Flashcards Quizlet

R2 M3 Tax Computation And Credits Flashcards Quizlet